Generally this is the process of accounting of Security Deposit collected from customers.

Security Deposit Management:-

Collecting of security deposits required from Business partners.

Tracking of security deposits collected from Business partners.

Refund of the security deposit when it is no longer required.

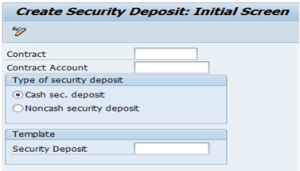

Type of Security Deposits:-

Cash Security Deposits (Accepted in terms of Cash or Check)

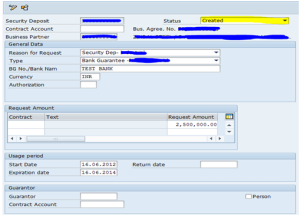

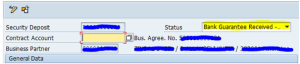

Non-Cash Security Deposits (In terms of Bank Guarantee or Letter of Credits or other available means)

Business Processes involved:-

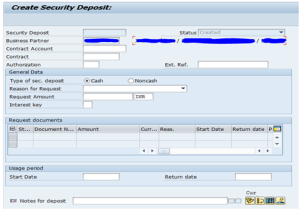

- 1. Request of Security Deposits

The security deposit requests are at the contract level.

Always creation of the security deposit is a manual process which triggers a security deposit request transaction, for mass creation you can develop a custom program to trigger this transaction.

Base T-Code = FPSEC1

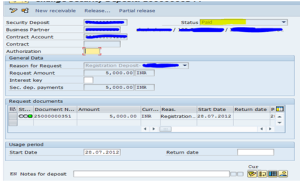

- 2. Receipt of Security Deposits

Cash Security Deposit paid by customer to the Company will be shown as a protected credit item in Business Partner account.

Cash Security Deposit once realized can’t be set-off against any other open item in customer ledger, during the account maintenance or payments made (Down Payment Concept).

The security deposit should have to be released from down payments first to set off against any other open item.

Instalment payment plan for security deposits is allowed based on certain criteria & can be customized as per requirements.

Base T-Code (Cash): FP05 / FP25 / FPCJ

(After Receipt status would change to PAID)

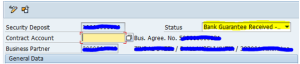

Base T-Code (Non-Cash): FPSEC2

(After Realization Status would change to RECEIVED)

- 3. Enhancement / Revision of Security Deposits:-

Consumption history

Request for change of plan type

Revision of gas price

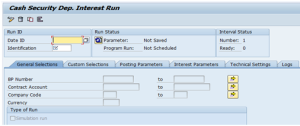

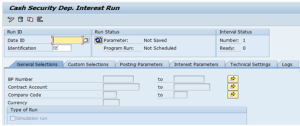

- 4. Interest on Security Deposits:-

The calculated interest is credited to the Business partner account till the date of release the security deposit (If released).

Base T-Code-1: FPI2

Base T-Code-2: FPINTM2

- 5. TDS on Interest paid for Cash Security Deposits:-

Withholding tax payment will be happen through Finance module.

TDS certificate will be generated to Business partner from FICA module.

- 6. Refund / Release of Security Deposit:-

Contract Termination

Final Billing / Invoicing

Name Transfer

Change in business Policy

Change in Plan, etc

Security deposit is now available to set off against open items in customer’s account if any. Otherwise it will remain ‘On Account’ which can be refunded to customer via check.

Base T-Code: FPRL

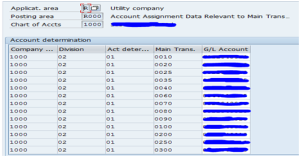

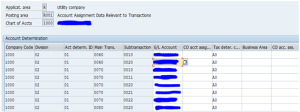

Basic Configurations:

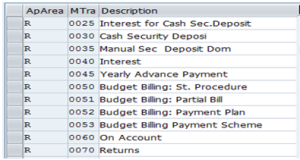

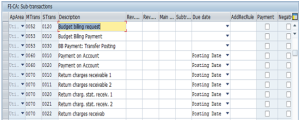

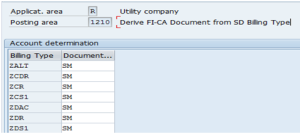

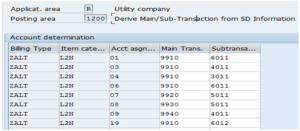

Posting Areas related to Security Deposits:

0800 Special Settings for Securities

0801 Specifications for Clearing Security deposit

1081 Cash Deposit Interest: Specifications

R200 Collateral transfer specifications for change of address

R201 Reverse collateral transfer specification for change of address

1083 Mass Activity Interest on Cash Security deposit

1086 Assign Transactions to Withholding Tax Code & Interest Key

EVENTS (SAP EXITS) Related to Security Deposits:

716 Correspondence: Print Security Request

717 Correspondence: Create Security Request

726 Correspondence: Print Cash Sec.Dep.Interest

727 Correspondence: Create Cash Sec.Dep.Interest

800 Security Deposit: Determine Transaction

810 Security Deposit: Determine Amount

820 Security Deposit: Master Data Check

830 Security Deposit: Form Printout

840 Security Deposit: Contract Check

860 Security Deposit: Due Date Monitoring

870 Release of Cash Security Deposit: Additional Checks

1778 Mass Activity: Cash Security Deposit Interest Calculation

2005 Cash Sec. Dep. Int: Interest Key Determination

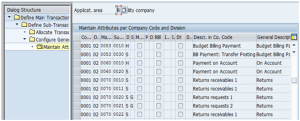

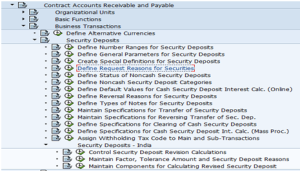

Following are the configurations related to Security Deposits:-

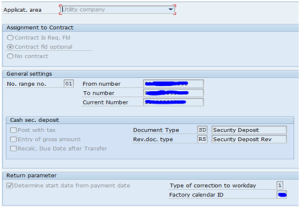

- Define General Parameters for Security Deposits

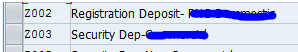

- Define security deposit Reasons

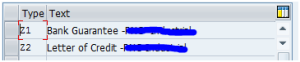

- Define Non-cash security deposit Category

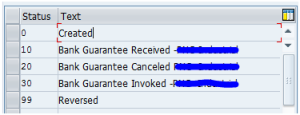

- Define Status for Non-Cash Security Deposit

- Define Number Ranges for Security deposit (T-Code: FPSEC0)

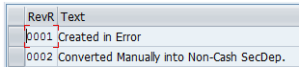

- Define Reversal Reason for Security Deposit

- Maintain Components for Calculating Revised Security deposit

- & other configurations as per requirement.